Social responsibility

and innovation

The Bank of Cyprus is successfully running through the 13th decade of its life. It set of as a Nicosia cooperative in 1899, with the Bank of Cyprus being established a few years later.

A story written for Cyprus and its people

Every organisation has its own unique, exclusive story. Certain companies and organisations stand out for their strong culture, their innovative work, their imprint on the country’s economy and society. And even further than that, a number of companies are always ahead of the pack, charting a course for the rest.

With a history of more than 120 years, the Bank of Cyprus remains the only banking institution that continues to operate uninterrupted in the Republic of Cyprus, becoming a point of reference for the finance sector, defining itself through its emblem which defines its own existence ‘Koino Kyprion’ (Cyprus for the Cypriots).

Today, following more than a century of life it is a leader in new transformations in the financial horizon, connected to technology, customer service, the thought process and its contribution to viable development.

Such a mission of course is not new to an organisation that had always been the leader in major changes and started out with the vision and mission of not just being a systemic bank that drives economic development and creating value for its stockholders, but above all, the driving force of progress for our society.

Steadfast in its values of integrity, credibility, cooperation, professionalism and innovation, it is timeless in always transforming at all its operation levels.

The visionaries

The course of the largest financial organisation in Cyprus was launched in 1899. A group of Cypriot visionaries, perceptive people, led by Ioannis Economides, who believed in the idea of saving and cooperatives, decide to forge ahead with an unprecedented move for its time.

At the time, the island was under British rule. The Cypriots, mainly farmers work for a daily wage, paying high taxation and thus stifling every hope and prospect for the financial and social development of the island.

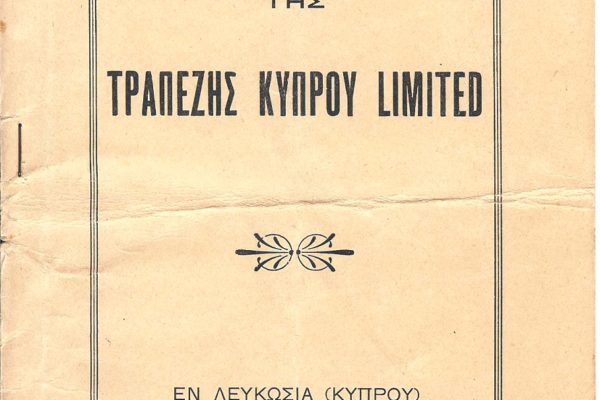

New Year’s Day 1899 marks the start of a course that will go down in history right through to modern times. ‘Nicosia Savings Bank’ is established and then evolves into the Bank of Cyprus. The Savings Bank concentrates capital on a weekly basis and each depositor has the capability of buying one stock by depositing one shilling a week for five years for every stock they want to acquire.

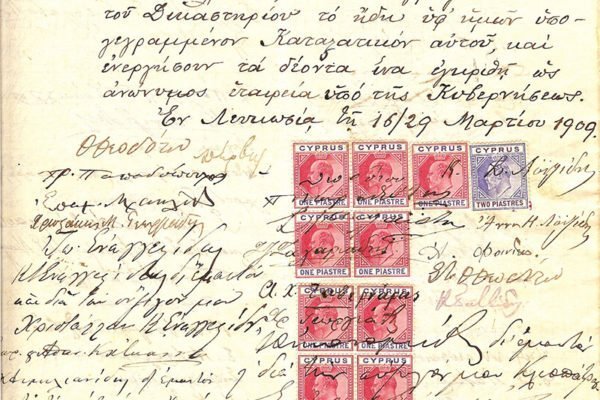

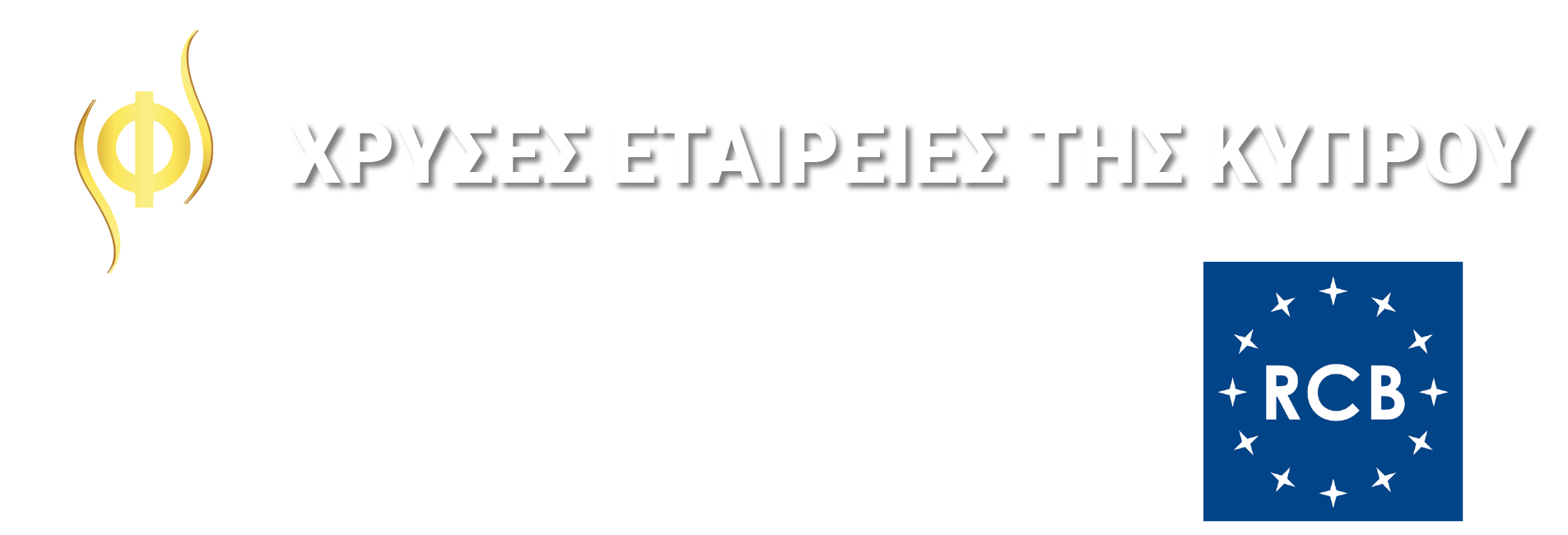

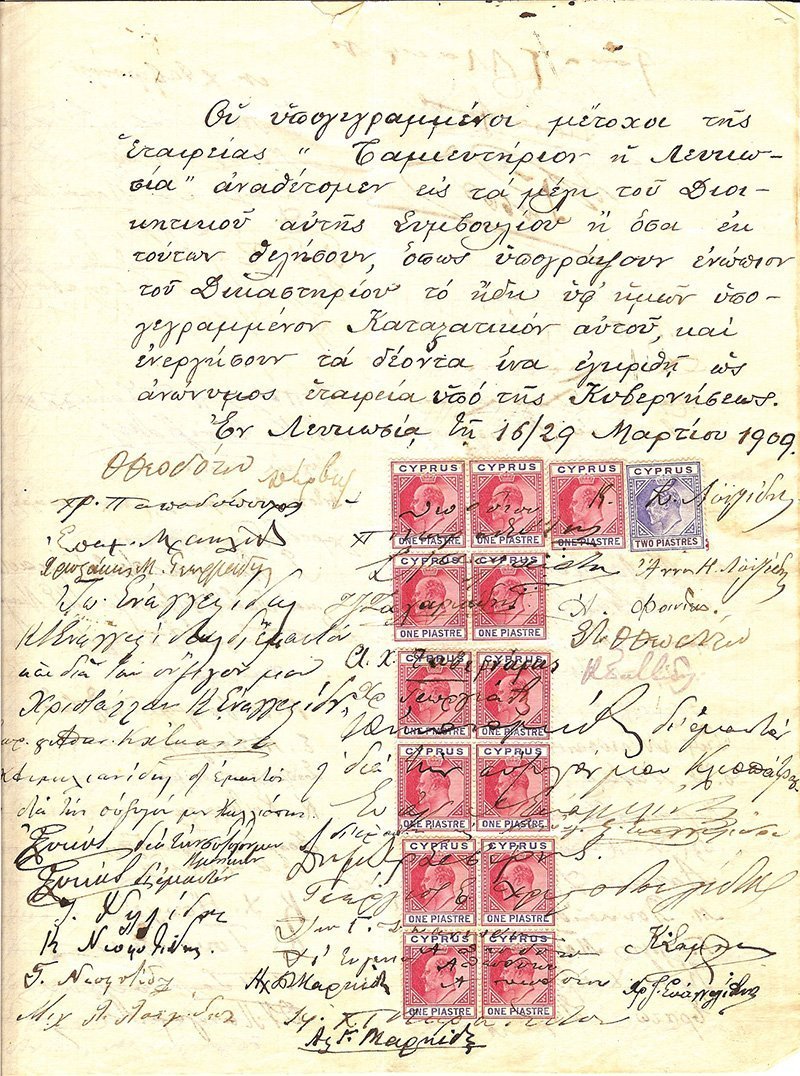

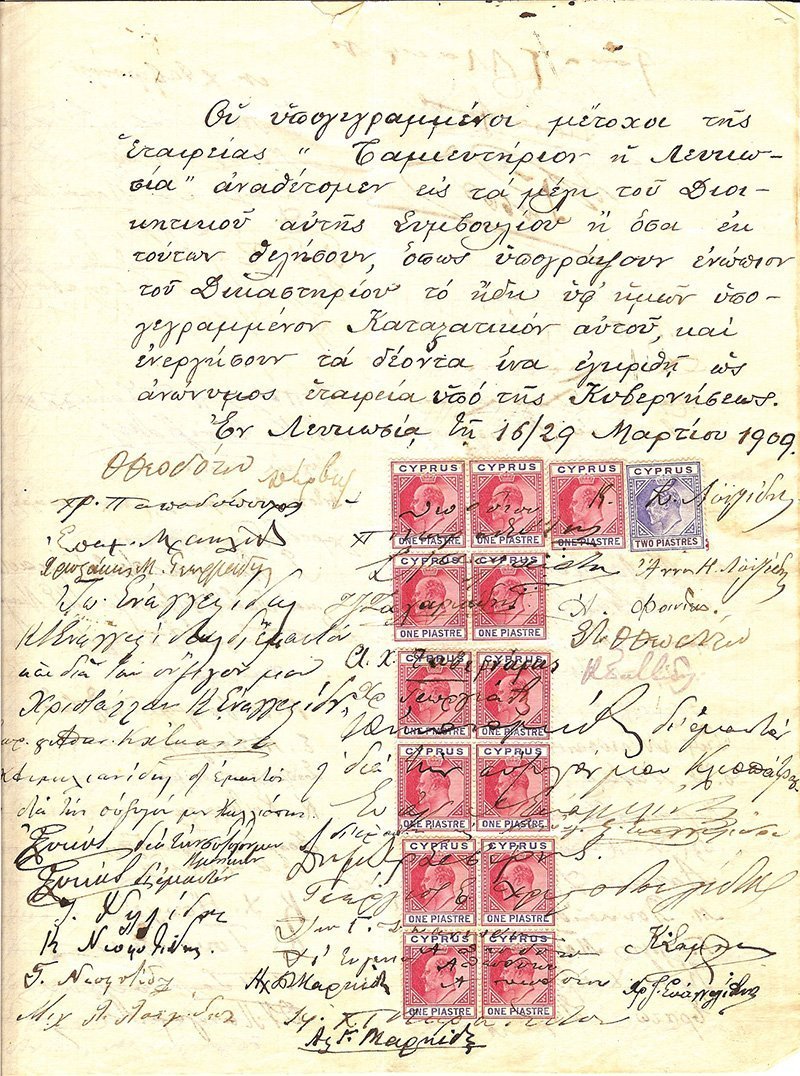

1909, Shareholder consent for registration of the ‘Nicosia Savings Bank’, or ‘Nicosia Depository’ as a public company.

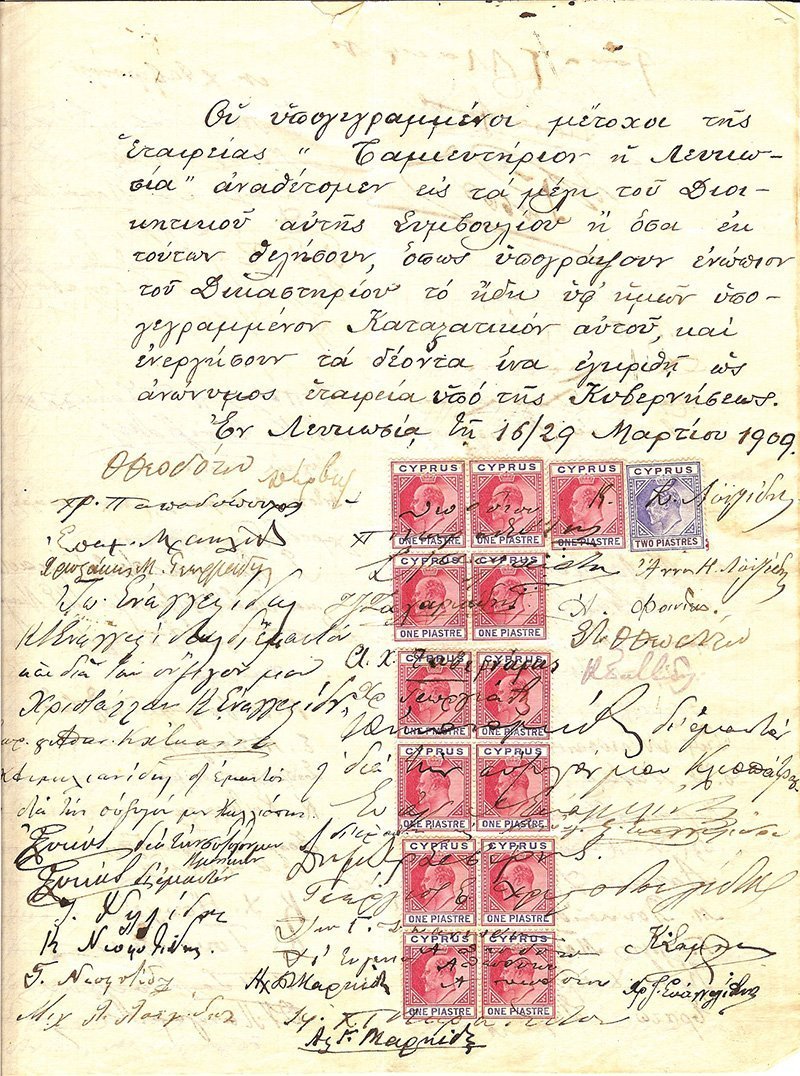

The first General Shareholders Assembly is held in February 1900. Twelve years later in February 1912, the stockholders sign a contract to turn the savings bank into a ‘public company named Bank of Cyprus with a duration of 30 years and a capital of 200 thousand pounds, divided into 50 thousand stocks worth 4 pounds each’.

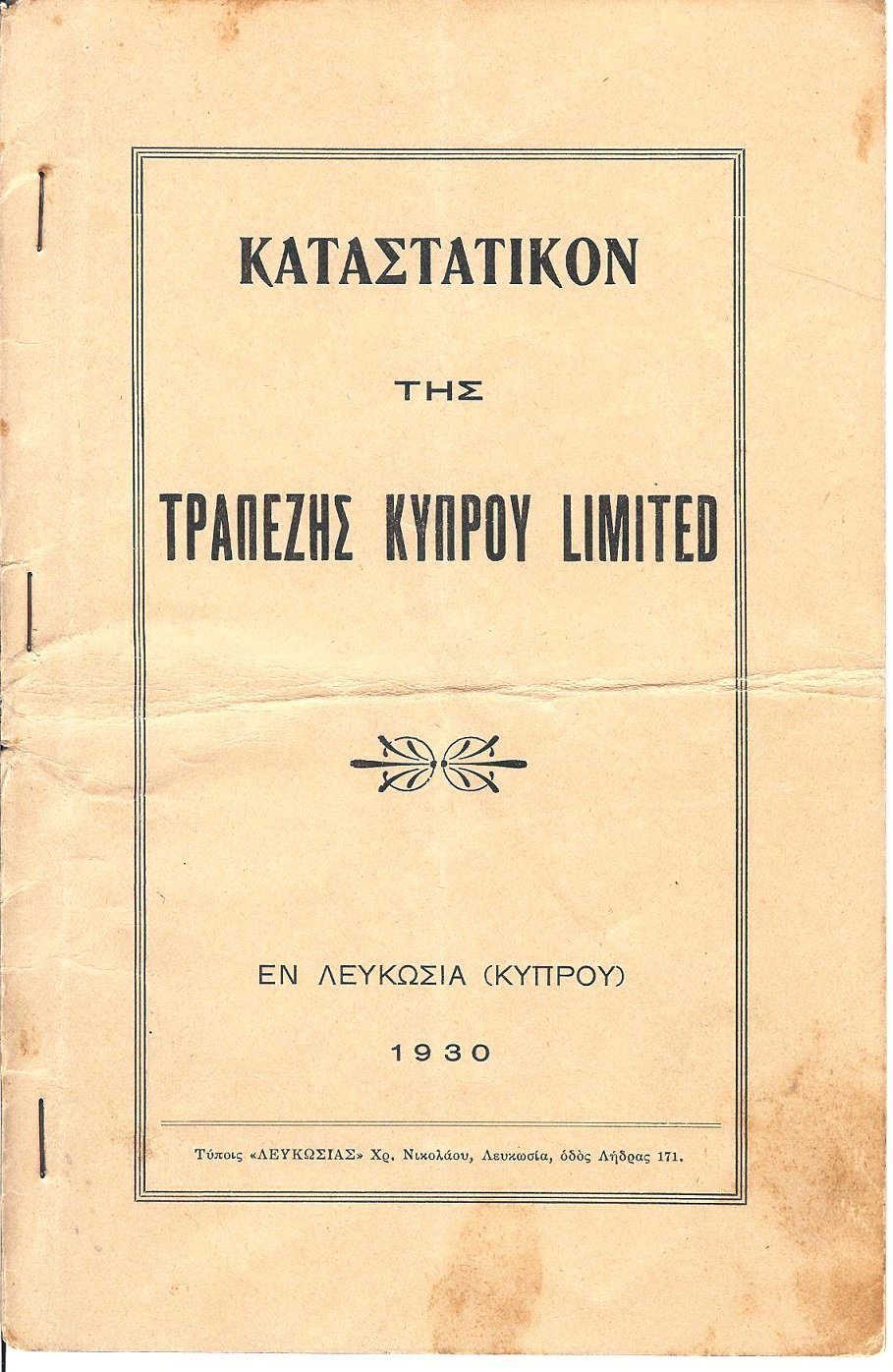

1930, Voice of Cyprus no.2249 (2555)

Under the slogan ‘Cyprus for the Cypriots’, the Bank of Cyprus took its next big step, following the successful management of the crises that ravaged the worlds’ economies in the wake of WW2.

The ambitious vision of ‘Koino Kyprion’ is implanted with the merging of other banking institutions in the rest of the Cypriot cities. The need for urban development rises, so in May 25 1944, the Real Estate Bank, with a capital of 15 thousand pounds, exclusively deposited by the Bank of Cyprus.

By the 1950s, the Bank of Cyprus was already half a century old and is housed at privately owned areas in Nicosia, Larnaca, Limassol, Morphou and Paphos.

In 1955, the Bank expands to London, following the immigrants to the colonial metropolis. With the establishment of the Republic of Cyprus in 1960, the Bank sets up the Housing Finance Corporation, supports entrepreneurship and funds people’s needs.

1976, ‘Global Hellenism’ magazine

In the 1970s, the Group establishes the Bank of Cyprus (Investments), buys out all the Banks and its subsidiaries’ stocks, also extending to non-banking fields.

The innovations of a different era

Always a leader, the bank takes innovative steps for its time. In 1967, it operates ‘Evlampios’ the first computer, adopting modern trends in computerisation and data processing. Evlampios offered its services to other organisations too, such as Cyta, the EAC and Cyprus Airways, by printing the bills that had been handwritten.

«Εvlampios», the first computer for data processing and storing

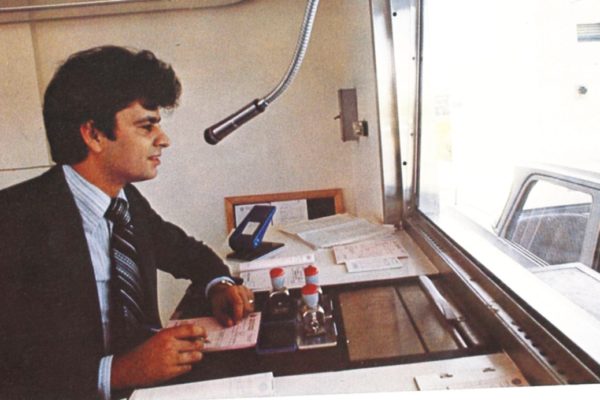

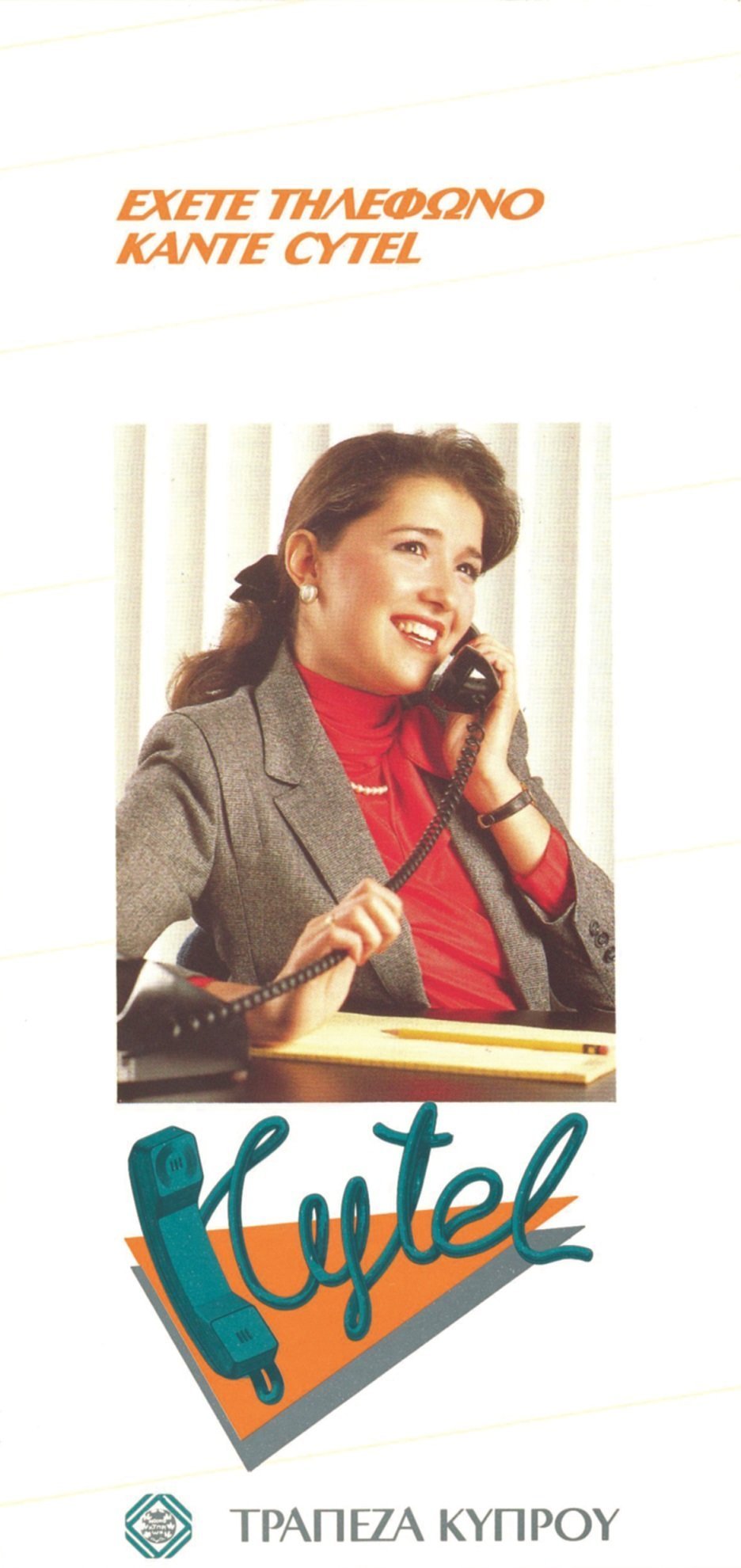

In 1974 it installed three ATMs in Nicosia with the slogan ’24 hour cash’ and nine years later it issued the CYCARD, becoming a leader in plastic money transactions. But what really revolutionary was the establishment of the CYTEL service in 1988, providing the option for the use of a wide range of banking services over the phone. The media talks about ‘The World of Tomorrow’.

1983, The issuing of the CYCARD credit card

In 1993, it breaks more ground with the first Unman Branch on Makarios Avenue. The client enters the branch, proceeds with non-contact transactions and leaves.

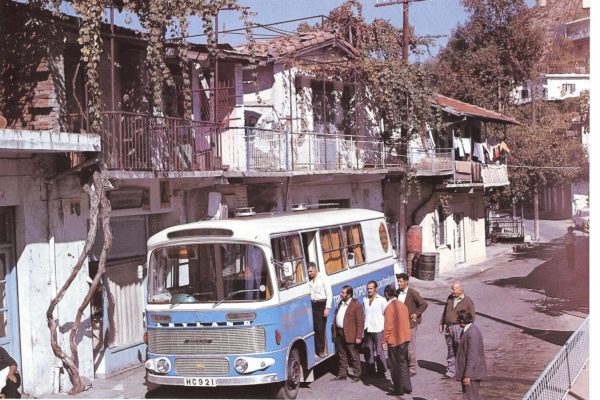

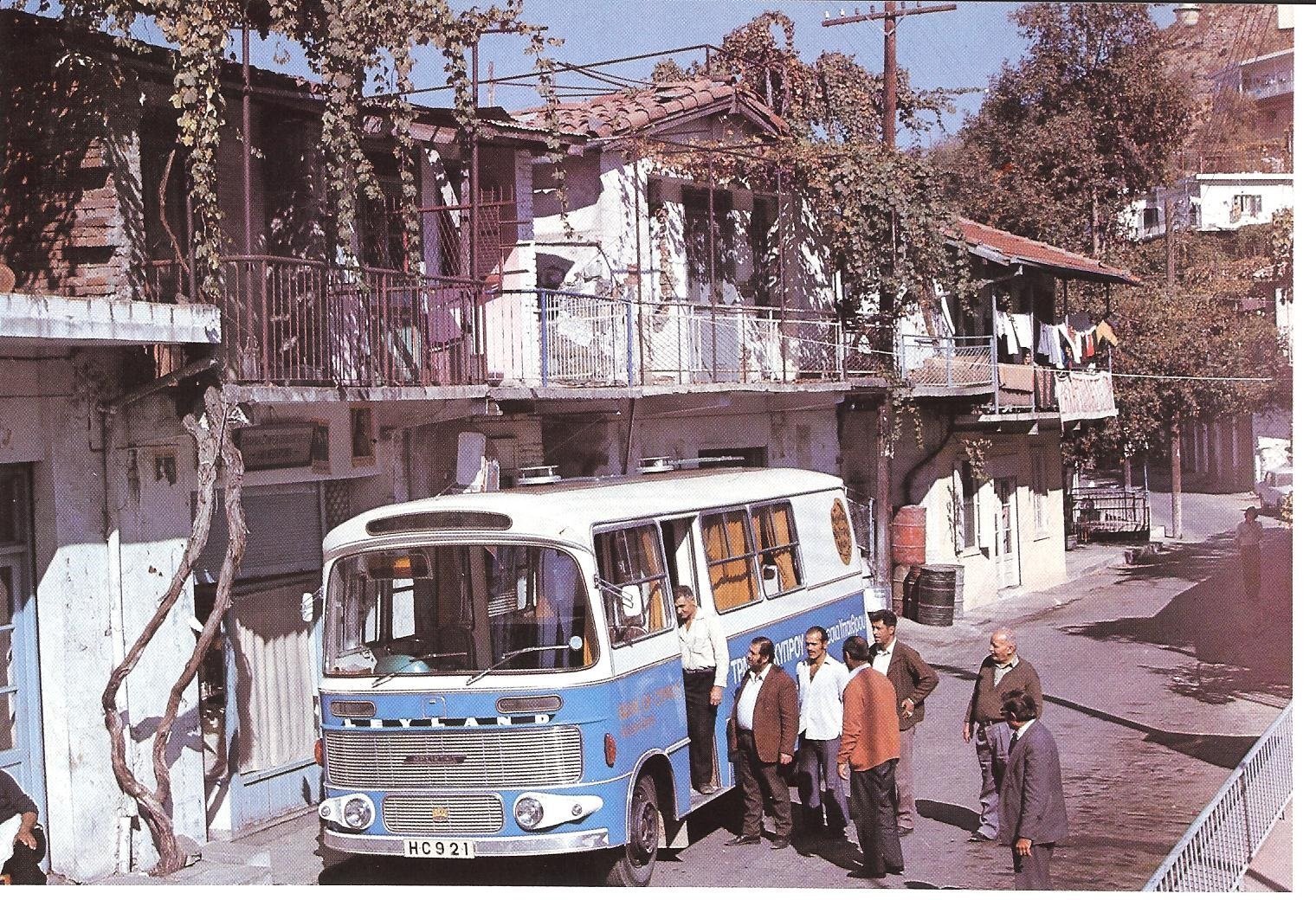

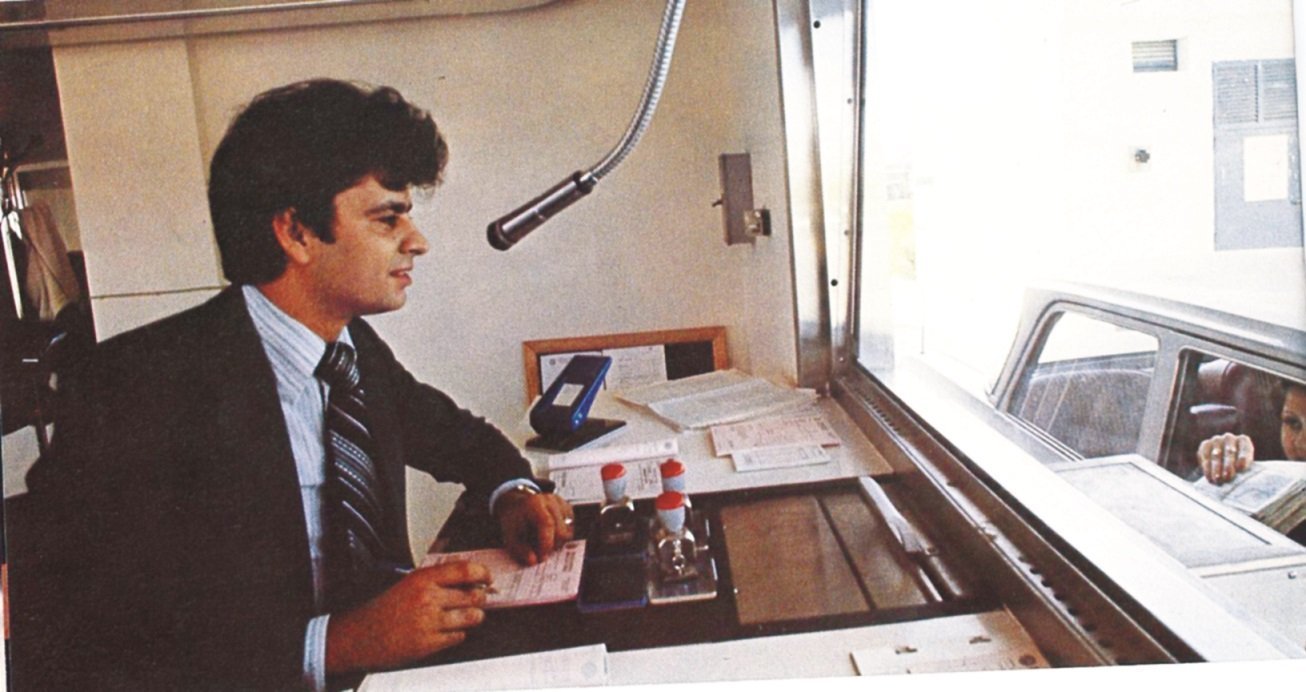

It also establishes the first Mobile Bank, the Vehicle Bank, a period bus that travels around rural communities and further opens the first drive in customer service in Limassol, where the public can proceed with transactions without getting out of their car.

The Bank stands by the people of Cyprus following the tragedy of the Turkish invasion. It donates 50 thousand pounds to a Relief Fund, writes off debts and withdraws all lawsuits against its clients.

1974, the characteristic mobile banking bus, serving the rural areas

In spite of its losses, namely branches and cash in the occupied territories, it decides not to be characterised as an affected company under Law 54, thus avoiding a temporary reduction of salaries.

1979, The first drive in branch in Limassol

In the 1980s, the Bank of Cyprus becomes a leader in the country’s reconstruction and the recovery of its economy. It acquires Chartered Bank in Cyprus and supports the new ‘economic miracle’ with wise decisions.

Expanding

1991 is a stand-out year. It inaugurates its first branch in Greece and the year after it establishes Bank of Cyprus Factors in Cyprus. In 1996 it operates as the first Greek speaking offshore bank in Guernsey, the Channel Islands and in 1997 it opens its first UK branch.

At the same time, it leaves an indelible imprint in culture and health. The landmarks were the establishment of the Bank of Cyprus Cultural Foundation (1984) and the Bank of Cyprus Oncology Centre (1996).

Bank of Cyprus Cultural Foundation, where the Bank’s Central Offices were housed until 1993

‘Life Chain’ is founded in the same year in order to strengthen the Anti-Cancer Society and the Christodoula March.

On the eve of the 21st century, the Bank introduces its stocks to the Athens Stocks Exchange and in 2000 it establishes the Bank of Cyprus Australia, opening the first branches. In 2007, it starts operating in Russia and Romania and in 2008 it acquires AvtoZAZbank in Ukraine and the 80% of Uniastrum Bank in Russia.

The financial crises is not slow to show its teeth, as it ravages the economy and the financial system. The sale of Bank of Cyprus Australia Ltd in 2011 marks the end of a time of growth. The Greek debt ‘haircut’ in conjunction with local political and economic conditions will lead the country’s two largest banks to a dead end.

Administration Building, Ayia Paraskevi

The crisis will continue through to 2014. What will prove decisive for the road to recovery is the increase of capital stock to the tune of one billion euro and the participation of foreign investors in the Group’s stock structure, the single largest investment in the history of the country’s financial system.

Over the next few years, with Joseph Ackermann as head of the Executive Board and John Hourican as CEO, Bank of Cyprus accomplishes the impossible. In January 2017 it pays off the Emergency Liquidity Assistance, a Popular Bank heritage, in the midst of tough financial circumstances. The international rating agencies point to a real ‘economic achievement’. In the same month, the Bank makes a return to international markets with the issuing of Tier 2 capital to the tune of 250 million euro.

It turns a new page in its modern history.

Bank of Cyprus landmarks

1899

- The ‘Nicosia Savings Bank’ is established and becomes operational.

1909, Shareholder consent for registration of the ‘Nicosia Savings Bank’, or ‘Nicosia Depository’ as a public company.

1912

- The Savings Bank is renamed ‘Bank of Cyprus’

1930, Voice of Cyprus no.2249 (2555)

1943

- Bank of Cyprus merges with banking institutions of other cities.

- ‘Koino Kyprion’ is adopted as the bank’s emblem.

1976, ‘Global Hellenism’ magazine

1955

- Bank of Cyprus (London) is established

1967

- Evlampios, the first data processing computer becomes operational

«Εvlampios», the first computer for data processing and storing

1974

- Supports the Cyprus economy following the Turkish invasion.

1980

- Acquires Chartered Bank in Cyprus.

1983

- CYCARD credit card is issued

1983, The issuing of the CYCARD credit card

1984

- The Bank of Cyprus Cultural Foundation is established.

Bank of Cyprus Cultural Foundation, where the Bank’s Central Offices were housed until 1993

Bank of Cyprus Cultural Foundation, where the Bank’s Central Offices were housed until 1993

1987

- CYBANK 24, a network of ATMs is developed

1988

- CYTEL is introduced for a wide range of banking services over the phone.

- The Electronic Centre is upgraded to an Information Technology and Technological Service.

- An Information Technology Strategy plan is implemented.

1991

- The Bank’s first branch in Greece opens.

- The Bank of Cyprus Medical Foundation is established.

1992

- Superbank becomes operational, a new electronic system connecting clients with the Bank.

1994

- The Bank of Cyprus implements the ‘Transformation’ plan for the automation of all operational procedures.

1995

- A Delegation Office is founded in South Africa.

- The first ATM Drive-In and the first full automated 24 hour service system become operational.

- The Direct cards are introduced providing direct payments from the clients’ current account.

1996

- The Bank of Cyprus offshore bank (Channel Islands) is established.

- The Canada Delegation Office is established (Toronto).

1997

- The first UK branch opens.

1998

- The Russia Delegation Office is established (Moscow).

- The Bank of Cyprus Oncology Centre becomes operational.

1999

- Τhe Bank of Cyprus Group moves to restructuring and its stocks (Investments) are replaced with Bank of Cyprus stocks.

- The Romania Delegation Office is established (Bucharest).

- Internet Banking becomes operational.

2000

- The Group’s stock is introduced to the Athens Stock Exchange.

- The Bank of Cyprus Australia is established.

- Sunmiles Visa and Internet Visa are introduced.

2002

- A new Ιnformation Technology infrastructure is introduced in the bank branches.

- Digipass is introduced by the Direct Banking Service to ensure the safety of internet transactions.

- A new operations platform is introduced under Windows 2000.

2004

- Bank of Cyprus (London) operations are merged with the bank’s branch in the UK.

2007

- Banking operations are launched in Romania and Russia

2008

- Banking operations are launched in Ukraine through the acquisition of AvtoZAZbank.

- Bank of Cyprus acquires 80% of Uniastrum Bank’s capital stock in Russia.

2011

- Bank of Cyprus Australia Ltd is sold.

2012

- The Bank applies for state capital support.

2013

- Τhe Bank comes under resolution from March 24 to July 30 following the Eurogroup’s decisions.

- The Bank is Restructured and Recapitalised through Bail In.

- The ensured deposits and the majority of assets and loans of Popular Bank Ltd were acquired.

2014

- The participation of foreign companies is achieved.

2015

- Uniastrum Bank Russia is sold

2017

- The Emergency Liquidity Assistance (ELA) is sold.

- Bank of Cyprus Holdings Public Limited Company stocks are introduced to the London Stock Exchange.

2018

- A deal is reached to sell the bank’s subsidiary companies in England

2019

- Τhe ‘Project Helix’ loan portfolio is introduced.

2020

- A deal is reached to sell Project Helix 2.

- #SupportCY support network is created.

The digital transformation and the CYON vision

The Bank of Cyprus is in the midst of a new course of transformation, modernisation and changes; digital and operational changes, thought process changes, cultural, services and human personnel changes.

The new, innovative digital ‘revolution’, is incorporated in an ambitious and timeless vision, Cyprus ON (CYON), a new philosophy and approach, bringing to life the digital economy of Cyprus, forging events and developments on the island and leading ‘Koino Kyprion’ (Cyprus for the Cypriots) into a digital age.

The Bank is upgrading its range of digital products and services, fostering a digital culture in its human personnel and training the Cyprus public to familiarise itself with the new realities and using the technology.

It is upgrading non-contact payments such as Apple Pay for safe card payments, BoC Wallet App, the android mobile wallet, QuickPay for payments using the beneficiary’s mobile number and Garmin Pay for smartwatch payments. It is also offering Fit Pay for payments with a Fitbit device and Settle for easy and free sending and receiving of money.

Ιt is breaking new ground with a new leap in the digital age, inaugurating a model branch that responds to the needs of the modern day client, as well as the electronic signature, as well as saving and funding through e-loans and e-Notice.

The new branch hosts a ‘Meet and Greet’ point, where specialised personnel welcomes the clients and advises them according to their service needs and solving any queries they might have.

The Bank of Cyprus innovative branch hosts specially design conference rooms for face to face meetings with clients.

Following the latest technological trends, all cash transactions are confirmed through pad electronic signatures instead of a traditional signature on paper.

The Bank of Cyprus is part and parcel of this history, struggles and conquests of the people of Cyprus and is always in solidarity with society.

The pandemic is only the launch pad for the organisation in leaving a new heritage bearing the name SupportCY, a network of supporting people as well as state bodies and services. In parallel, the IDEA Innovation Centre supports entrepreneurship and innovative ideas.

A new world is dawning, a different sunrise for its people. The Bank of Cyprus moves forward with new ideas and is committed to supporting and encouraging the major changes being introducing to conquer the bright digital future and other revolutionary visions.

Social responsibility and innovation

The Bank of Cyprus is successfully running through the 13th decade of its life. It set of as a Nicosia cooperative in 1899, with the Bank of Cyprus being established a few years later. Throughout this course, the Bank became distinguished for its Cyprus-centered character, innovation and social contribution. ‘The same holds true to this day’ says Bank of Cyprus Managing Director Panicos Nicolaou, who talks past, present and future.

How do you feel at the head of a 122 year old banking group?

First and foremost, I have a sense of responsible. If someone considers what this group has been through from 1899 to this day and more so what it represents for Cyprus society, you become in awe of your responsibility. Many of the things that were built through a course spanning almost 110 years, fell apart in 2013-2014, so the primary purpose for a long period of time, was to re-establish the trust and respect of society to the Bank of Cyprus. And to a great degree we have managed that, by achieving our goals, such as reducing Non-Performing Loans and paying off Emergency Liquidity Assistance, as well as restructuring client services.

Panicos Nicolaou, Managing Director

DNA through society

Every organisation forges a culture through its history and course. It’s own DNA. What is the Bank of Cyprus DNA?

The Bank of Cyprus DNA is the Cyprus society DNA. An organisation that was always innovative. It’s not just a financial institution.

Leadership has always been the outstanding characteristic of this Group. For example, the Bank introduced the first computer to Cyprus in 1967. It was the first to introduce the ATMs, the credit card, internet banking, mutual funds and many others. More than being the first bank in Cyprus, it also forged the first insurance organisation made from Cypriots, for Cypriots, and all that before the end of British rule. It was also the Bank of Cyprus that supported the rise of women in the banking sector.

1988, The introduction of CYTEL, allowing the client the capability to use a wide range of banking services over the phone

It all started in 1899

Bank of Cyprus was founded in 1899, initially as the ‘Nicosia Savings Bank’. Thirteen years later it turned into a public company and renamed Bank of Cyprus. What does today’s Bank of Cyprus have with the institution of 1899 and 1912;

The goal and vision back then was to forge an organisation that would fund Cyprus society, the Cypriot household, business initiatives and the development of the country. The same holds true today. If ‘banks give out loans’, we view our operations very differently: We found and support.

Whether that’s your new home, business, expansion or an employer providing jobs, our role is not to just ‘provide loans’ but support the dreams and successes of every support.

1909, Shareholder consent for registration of the ‘Nicosia Savings Bank’, or ‘Nicosia Depository’ as a public company.

‘Koino Kyprion’ and today

In 1943, mergers expanded the Bank to all cities and the Claudius (43-44 A.D.) coin was adopted as the Bank’s emblem, ‘Koino Kyprion’. Right through to 2013, ‘Koino Kyprion’ was not just an emblem but put into practice at least when it came to the Bank’s stock structure, with thousands of small and mid-sized stockholders. They held the large majority of the Bank’s stock capital. Today the bank is mostly owned by foreigners and very few of them at that. How does ‘Koino Kyprion’ hold today with a totally different stock structure?

A large percentage of the Bank’s stocks are also owned by Cypriots today. They hold around 30%. But we must not really focus on that. The Bank’s commitment to Cyprus, its sense of responsibility to society, our role in social and technological innovation-all these are an expression of our dedication to ‘Koino Kyprion’, ‘Cyprus for the Cypriots’. The stock structure is a different issue. Today we are called upon in another chapter of our history, to rejuvenate the restart, protect employment, support viable businesses but also safeguard the health of our colleagues, clients and associates. Τhis is exactly where our working relationship lies with Cyprus-its history and future, not just through stock structure..

Administration Building, Ayia Paraskevi

There was a major change in 2013, when the Bank of Cyprus, amongst other things, absorbed the operations of Popular Bank. Where did this leave the Bank?

Let’s start from the fact that a major part of our efforts post-2013 was focused on paying off the Emergency Liquidity Assistance (ELA) inherited by the Popular Bank so that the state and the taxpayer wouldn’t have to bear the burden. In addition, the portfolio we inherited, along with the credit worthy clients, also included openings that either were or turned to NPLs and in combination with those of Bank of Cyprus, increased the loans we needed to manage. Those were the two challenges, the ELA and the NPLs inherited by the crisis.

Having said that, we also took on board many able colleagues who were quick to fully integrated and have already contributed a great deal-there is now no difference in the personnel’s commitment based on where they came from.

Besides, the Bank of Cyprus has a long history of mergers and over time has absorbed other banks’ operations, even at the early stages of its life, such as the Famagusta Bank, the Larnaca Bank and Melissa Bank in Cyprus; followed much later by Chartered Bank. So mergers are part of our DNA.

We unloaded the ELA from the taxpayer

We then move to a different period, 2013 to 2019. A tough but also interesting period. What stayed with you?

First of all that ELA was paid off in 2017. Don’t forget that the Popular Bank’s obligation of more than a 9 billion euro ELA was transferred to the Bank of Cyprus. The success mostly goes unnoticed, partly because it was achieved so smoothly. But no one beyond the Bank actually believed that we could have managed. Secondly, the Bank went out to the markets in 2014 and brought in capital of one billion, the largest ever investment in Cyprus. Thirdly, it was the first bank that managed to sell off NPLs, under tough circumstances at that-firstly due to uncertainty and then in the midst of the pandemic. But the most important of all, was regaining people’s trust, a proven fact through the trust indexes, as well as deposits.

The pandemic and the kickstart of the economy

This was followed by the pandemic that is still with us. What damage will this inflict?

I think that when it comes to people’s trust, the pandemic has only left us with benefits. Through the pandemic, our Group has proven its dedication to the Cypriot citizen and one example is SupportCy, which has contributed a great deal and continues to do so, to anyone in need. It’s an institution that will continue post-pandemic. Beyond all else, this particular effort has shown the Bank’s fast response and instincts, as the first call to SupportCy, was made just three days following the announcement of the first covid case.

On the other hand, the pandemic has inflicted serious pressures on the country’s economy. We had 6 billion euro in loans under a nine month suspension and we needed to handle things early. Today, around 95% of clients pay their installment on time.

I should also note that when the pandemic broke out, the NPLs were at 30% and 2020 ended with 16%, taking into account the conclusion of the Helix 2 sale, while also having high capital indexes.

It would of course be utopian for anyone to claim that the pandemic will not leave its mark on the economy and by extension, the banking system. There will be new challenges for the banks portfolio and new NPLs created, the size of which is still early to calculate. As long as the economy continues to recover, we remain optimistic. On our part, we are prepared for that and above all, really feel strongly about supporting viable businesses in order to avoid employment repercussions as far as possible.

What do you predict for the Cyprus economy? What’s the recipe for the restart?

I should say that the Cyprus economy is very small and very flexible. And if I look back at how 2020 developed, starting from the 2nd quarter onwards and how the 3rd and 4th went, given the conditions, the economy did well. So I believe that the Cyprus economy will bounce back quickly in spite the fact that new problems will emerge out of the pandemic.

There is incredible liquidity in the market with a great number or deposits in Cyprus Banks. At the same time, unemployment is under control, particularly in comparison to other countries. So if we manage, away from political expediencies, to utilise the capital from the Recovery Fund-quite a significant amount-and go ahead with real reform, then the Cyprus economy will easily recover. Economists, the European Commission and the International Monetary Fund estimate that by late 2022, we will be reaching pre-pandemic GNP levels.

Standing by society with many projects and activities

Has the Bank of Cyprus adapted to the new age? After all the Recovery funds point to a green and digital economy.

The Bank of Cyprus has already taken steps towards that. We have set up Restart Cy. Both Support Cy and Restart Cy can be used, if we really want and can, to fund the growth of the economy along with the state. We are ready as an institution.

Our digital transformation has progressed and keeps moving ahead. Right now we have nothing to be envious about, not just from any Cyprus bank, but also any banking institutions in central Europe. I will mention two indicative elements. Today, 75% of clients perform their transactions electronically with 85% of transactions conducted digitally.

Throughout this 122 year history, is there any incident that you’ve heard, read or experienced and you want to share with us?

When one reviews this great history, particularly what the Bank has achieved at a social level, then I can recall many things. The Oncology Centre for example that we opened in 1996. We have so far spent 70 million euro for the Bank of Cyprus Oncology Centre, an amount increasing every year. Not to mention the Bank of Cyprus Cultural Foundation, quite a major foundation with a social contribution since 1984. And then there’s the IDEA Innovation Centre, providing the opportunity to young entrepreneurs to implement their business ideas.

Now, looking back, we see a lot of moves during the wars, or even the 1917 pandemic. The bank refused to apply for support in 1974, in spite of fulfilling all the criteria. Another example is when the Bank paid all the salaries of 1955-59 political prisoners. The list is endless. That’s what the Bank of Cyprus is all about and our goal is to move ahead this way, finding ways of giving back even more.

Is all the above part of the Bank’s Corporate Social Responsibility?

It’s much more than Corporate Social Responsibility. We want to be more than a bank. And then there’s the ESG, Environmental, Social and corporate governance, which we gradually would like to incorporate into the classic form of Corporate Social Responsibility.

The Bank for the next age

What are the banks goals in the immediate future?

We have to complete this huge NPLs effort and reduce them to a single digit percentage from today’s 16%. It’s a goal that we believe will be achieved in the next year. Beyond that we aim to forge a business model that is in line with today’s conditions and is based on digital transformation.

Our goal is to be a profitable organisation that can reward its stockholders, but on the other hand also be in a position to continue its long standing contribution, both culturally, health wise with the Oncology Centre, innovation, with the IDEA centre, as well as any other sectors.

At the same time, we are also focusing on what distinguishes our Bank. To be innovators in all fields, particularly digital transformation-not just the bank’s, as we are way ahead in any case, but the whole of Cyprus economy and society. This is a national issue.

As a bank, we try and move things forward as much as possible and as far as our role allows us. But I do repeat that things don’t just depend on us and I’ll give you an example. We have introduced the electronic signature and utilising this innovation. But the user of this signature cannot do the same in public services so that procedures become simplified, people are provided with faster services, expenses are reduced and the citizen is encouraged to use it. Where is it used? At the land registry, the Companies Registrar. Where else? Almost nowhere. So we are obliged to push our own country towards this direction, otherwise an important opportunity will be missed for everyone.

What does the Bank have in store on digital applications?

Towards the end of this year and the start of the next, you will witness major changes in digital services that are far ahead of what is available in Cyprus. We simply don’t have a choice. We need to move ahead both as a society and an economy, not forgetting our own course as Bank of Cyprus. We’ve already supported movements, not publicly, but through our knowhow and we are at the state’s disposal to support other moves too.

We’re more than a bank

How would you like to close this out?

I will stress once again that this organisation constitutes much more than a bank and that’s proven throughout its history, more than two times that of the age of the Republic of Cyprus. So by surging ahead with our new business model, centered on technology and digital transformation, I believe we will once again become the pillar of the Cyprus economy and society as a whole over the next decade. In other words, we will move ahead with the historical continuity of ‘Koino Kyprion’, but also having in mind that we are innovators and leaders in whatever we do. We are obliged to introduced innovations, new products and procedures to Cyprus society and not just the Bank of Cyprus. It’s not enough for us to be digitally ready, our client and the rest of the economy’s players need to be too, otherwise there’s no point. We all need to look ahead, faster. We have to stay ahead of our clients’ needs to be ready to welcome them when they arrive in this digital age, as it happened in the past on many occasions.

Address.

51 Stassinos Street,

Strovolos, P.O. Box 21472, 1599

Nicosia, Cyprus

Phone.

800 00 800