A company keeping up with the times for 70 years

The insurance sector keeps changing over time and insurers find themselves in need to keep up with changes, be flexible and constantly adapt their operational model. Genikes Insurance has been a good example of this for seven decades, showcasing their resilience and results without compromising their reliability.

A company keeping up with the times for 70 years

The insurance sector keeps changing over time and insurers find themselves in need to keep up with changes, be flexible and constantly adapt their operational model. Genikes Insurance has been a good example of this for seven decades, showcasing their resilience and results without compromising their reliability.

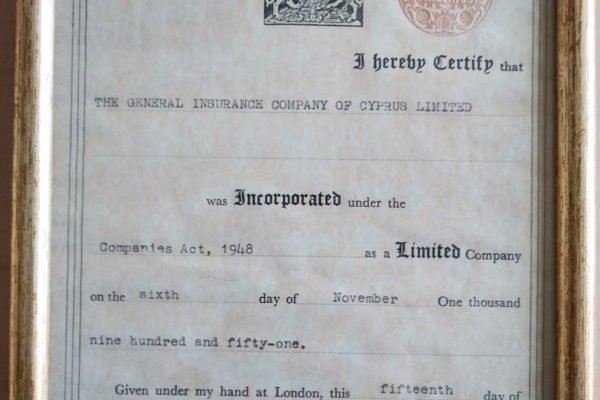

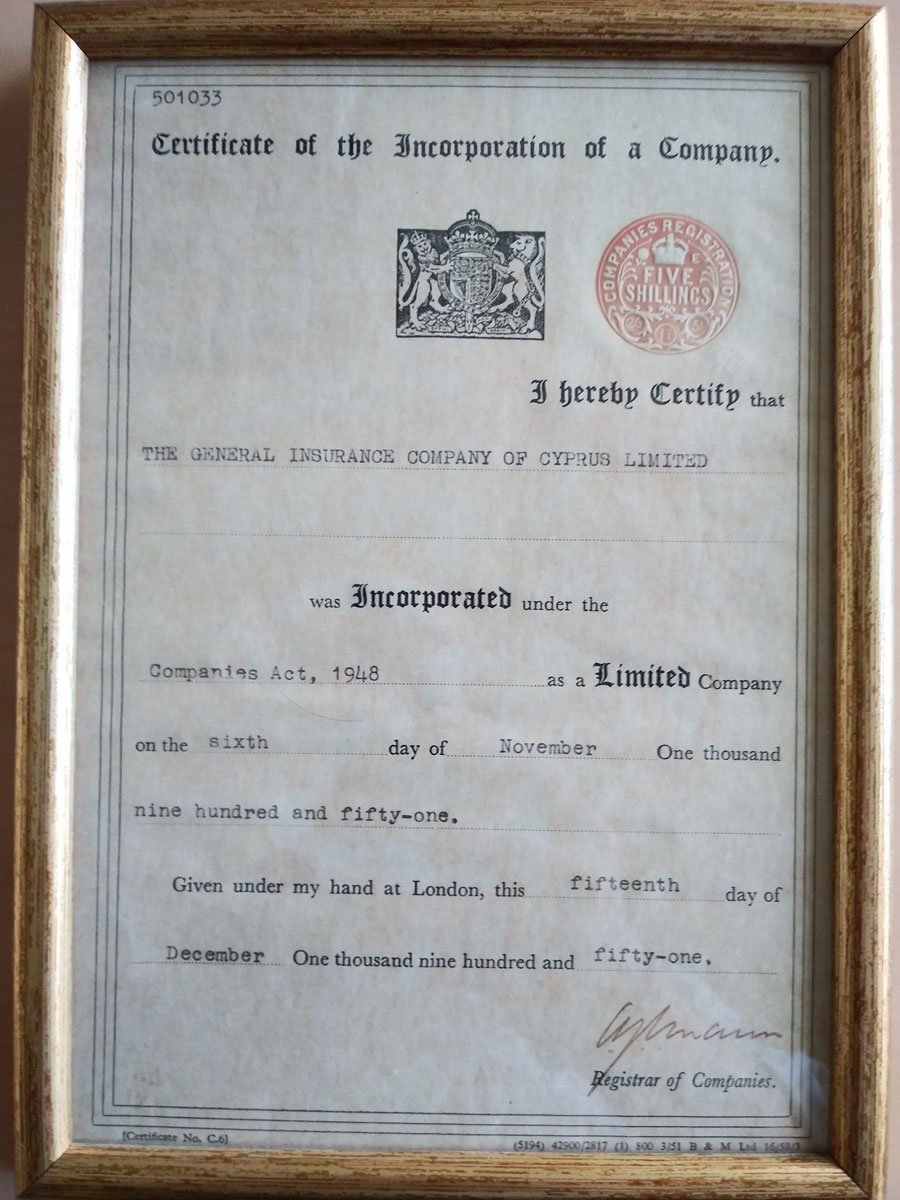

The original Certificate of Incorporation (London 1951).

Establishment

In the early 1950s market needs provided fertile ground for the establishment of a local insurance company.

At the time, no less than 55 foreign insurance firms were active on the island and the Bank of Cyprus Executive Board decided to fill that void. The establishment of a locally owned insurance company was meant for the good of the country as well as for the interests and prestige of the Bank itself.

As local legislation, at the time, did not allow for the establishment of insurance companies in Cyprus, the Company was registered in London, overcoming various obstacles and processes.

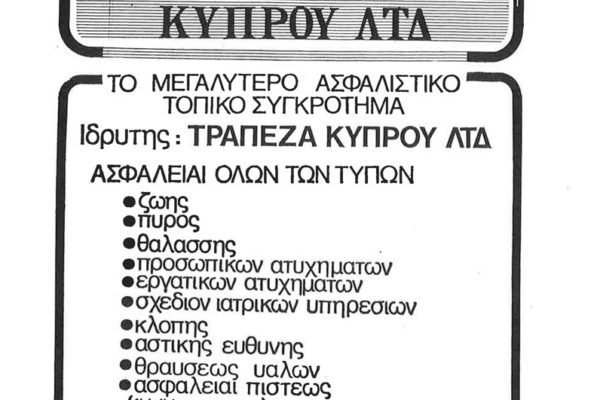

On November 6, 1951, under the corporate name The General Insurance Company of Cyprus Ltd’ with a capital of 150 thousand pounds, Bank of Cyprus and Cyprus Real Estate Bank took the first step of what would prove to be a long and successful journey.

1952 is a landmark year for Genikes Insurance, as they launched a fire insurance Cover.

By the end of the year, 563 insurance Policies were in place, representing an ‘Insured Capital’ of £1.588.599.

The reinsurance company was ‘The Mercantile and General Reinsurance Company Ltd» with a stake of 90 to 95%.

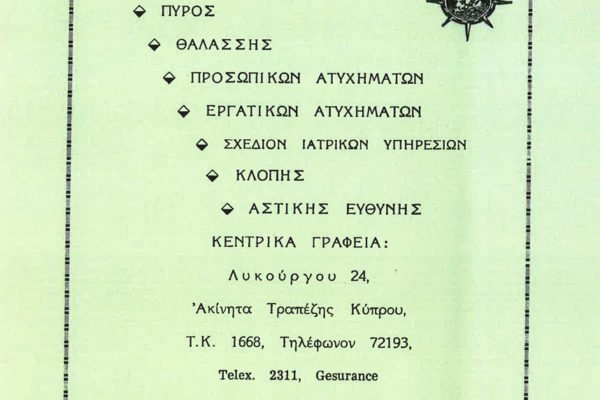

An old company logo.

The Ledras Street building

The Company moved to its owned home at an early stage. Ledra Estates Ltd, 50% owned by The General Insurance Company of Cyprus Ltd and 50% by Eleni Simou Menardou, was established in November 1953 with the sole purpose of purchasing real estate in the capital’s historic centre.

As sourced from documents of the time, the Company proceeded with ‘the purchase by Mrs. Eleni Simou Menandrou of a most central property in Ledras Street, today housing the Alkmini hotel, with the goal of building a new modern headquarters’.

Ledra Estates Ltd also bought the old Dianellos and Vergopoulos factory.

The 1958 hostilities brought turmoil to the local population, at the same time presenting a major challenge for the newly established company, as it had to pay fire damages following the violence.

Social and economic developments were central to the progress and development of Genikes Insurance.

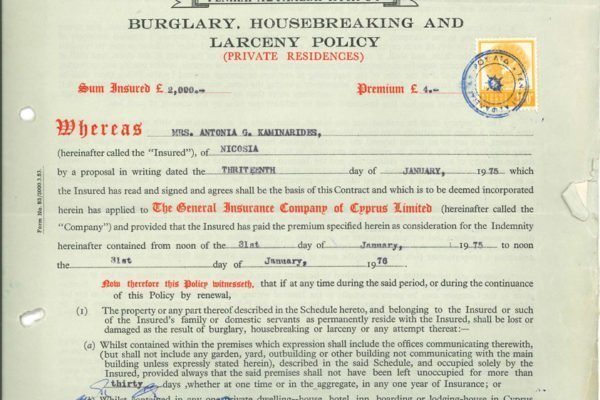

New realities then brought about the necessity of new insurance Plans and Covers on theft and robbery.

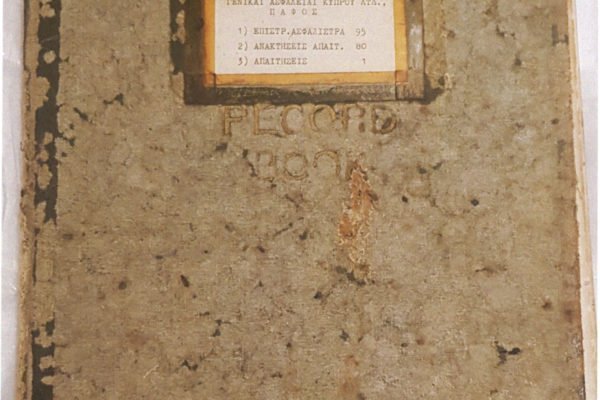

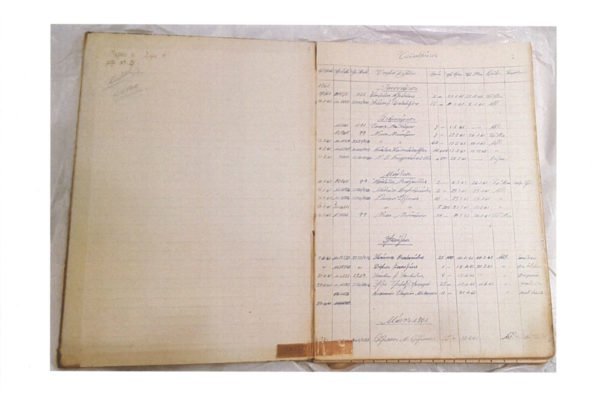

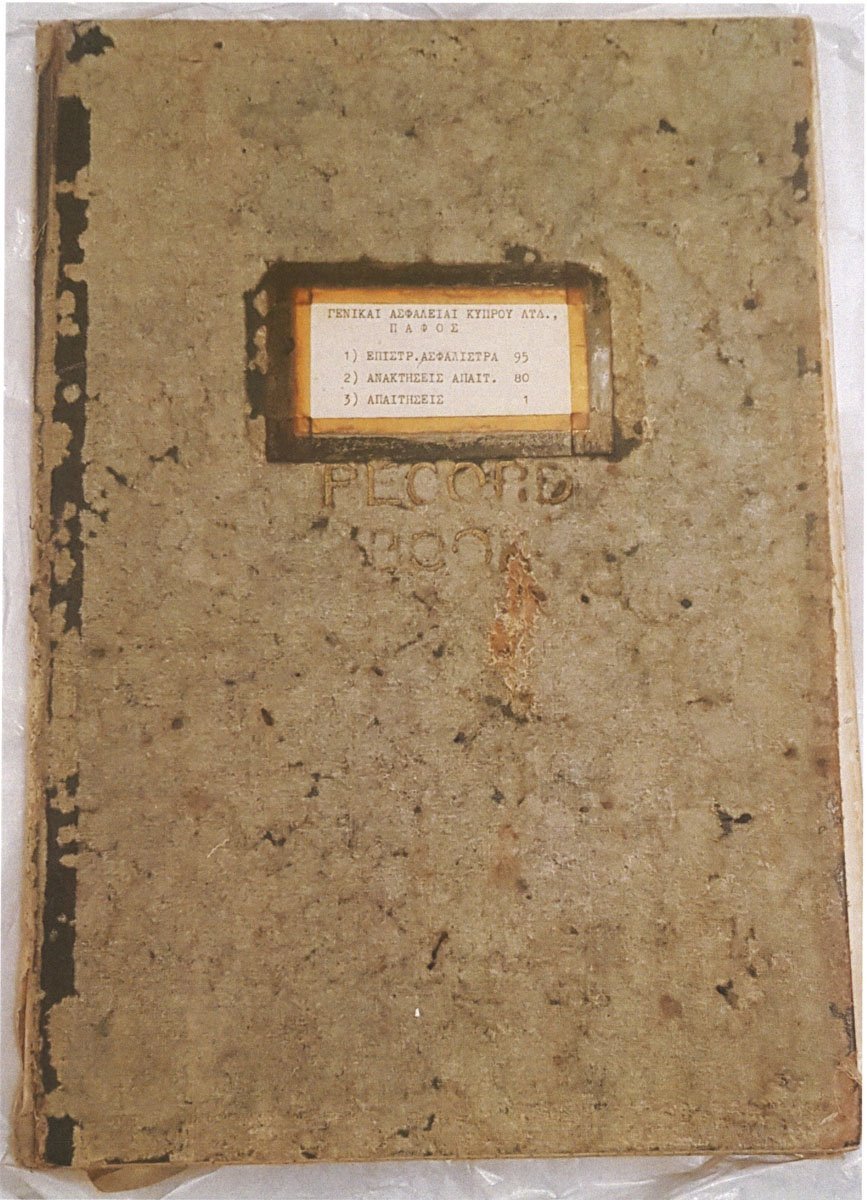

Claims record Book 1961.

New insurance Plans

The company gradually introduces additional Plans, such as:

- Loss of profit from fire insurance

- Construction insurance

- Machinery insurance

- Accidents insurance

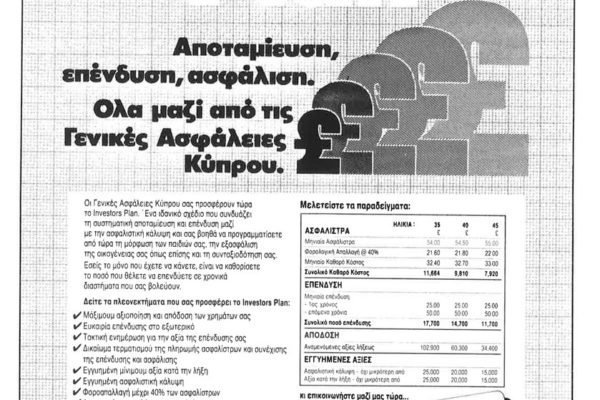

But it wasn’t just social changes demanding new products. The 1980s saw an intensified competition in the insurance sector, with no less than 45 companies operating in Cyprus (1986 records).

Genikes Insurance offered Plans on both main insurance sectors (Life and Property/Responsibility Insurance), covering private and group schemes for security and investment. Despite the fierce competion, Genikes Insurance remained top of the pile in total premiums.

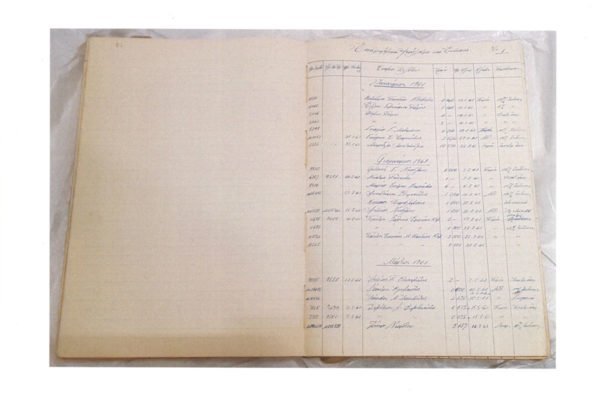

Insurance Policy document (1975).

Culture and society at the forefront

The Company has a strong cultural identity, translating initiatives into action. Working alongside Bank of Cyprus Cultural Foundation, together they have taken up major cultural and social projects that have left their mark on the country.

Supporting the State has always been at the forefront of the Company’s CSR initiatives. Genikes Insurance have been contributing since the early 90s to the enhancement of our national defence, organising a series of concerts with Yiorgos Dalaras.

A leap in technology

Genikes Insurance established an innovative Bancassurance model being, at the time, a major advancement in the financial sector. The same period witnessed yet another leap in technology. In 1997, the company’s electronic archiving and management of records system was completed, significantly reducing operational costs and improving efficiency.

2000 a landmark year

2000 was a particularly significant year, with a major rise in the company’s financial results/profits. Additional progress was made in implementing its’ strategic goals, such as the license to expand to Greece and the direct sale of Insurance Plans over the phone.

The introduction of insurance over the phone was yet another Genikes Insurance pioneer move.

Adopting the latest technology, the innovative ‘Tilefthia’ service was introduced to the market in 2000, providing the opportunity for the purchase of car insurance over the phone.

The great opening

In line with its strategy to expand banking operations to Greece, Bank of Cyprus Group secured the necessary license to provide insurance services and products in Greece. In 2001, the Genikes Insurance branch in Greece became operational, under the trade name ”Kyprou Asfalistiki”.

This strategic move allowed the company to provide insurance services and products to Bank of Cyprus clients in Greece, create a balanced portfolio through comprehensive evaluation and risk assessment and utilise synergies with other Bank of Cyprus Group departments.

Kyprou Asfalistiki Logo.

Client support

The growth and the rise in Premiums and market shares is clearly indicated by the company’s expansion moves. In 2003, the Company reorganised its’ central services at the same time opening a branch in Nicosia.

Genikes Insurance was the first insurer in Cyprus to offer the purchase of insurance plans over the internet. Online insurance was launched in 2017 offering Motor, Home, Travel, Hunters’ and Driver’s Plans.

Genikes App

Moving into the 2020s, Genikes Insurance once again responds to the need for innovation, enhancing their mobile App with a file-aclaim feature.

Clients are able to directly file a vehicle damage claim with no additional procedures and delays.

Genikes App continues to ‘find you wherever you are, with road assistance at the press of a button. Using GPS tracking, Genikes App can accurately track the location of your vehicle in case of accidents or other road assistance’.

Genikes Insurance is an industry leader, widely considered as one of the most reliable companies in Cyprus.

Genikes App application with the ability to submit a Claim via mobile.

Social support during the pandemic

Unexpected obstacles and crises always test business endurance. The covid-19 breakout in Cyprus changed the Genikes Insurance priorities, but not their goals. The pandemic catches the company in a period of digital transformation process. This transformation was not interrupted. Instead it has accelerated ever since.

According to a spokesperson, ‘the company’s no 1 concern during the health crisis, was the well being of staff, clients and associates. Beyond that though, vulnerable groups had the greatest need for care. So Genikes Insurance facilitated the repatriation of these vulnerable groups by funding a flight in coordination with the state, to bring them back home’.

As the company put it, ‘this was not the only time that Genikes Insurance showed their humane face. The devastating fires on the Larnaca and Limassol mountains moved Genikes Insurance, which donated, in the summer of 2021, a fully equipped all ground vehicle (ATV) to the Crisis and Disaster Support of NGO Reaction, in the framework of the Bank of Cyprus SupportCY. In addition, as per contractual obligation, the company responded swiftly to all relevant client claims’.

Our new corporate identity

2021 marks a significant change in the Company corporate identity. With on outlook toward the future, Genikes Insurance updated and modernized their corporate identity by introducing a new, cleaner, more up-to-date logo.

At the same time, the new identity continues to adhere to the Company history, identity and values, as part of Bank of the Cyprus Group.

The Company’s General Manager, Costas Costa.

Reliability, growth, innovation

Genikes Insurance was established on November 6, 1951 by Bank of Cyprus and Property Bank of Cyprus, under the trade name ‘General Insurance of Cyprus Limited’, with a capital of 150 thousand pounds.

Throughout its long-standing history, the Company has maintained a leadership position in the insurance sector, providing a wide range of insurance products that cover the needs of individuals and businesses.

General Manager, Costas Costa spoke about the Company’s past, present and future.

What’s it like leading such a historic organisation?

A sense of pride for the accomplishments of the Company and also a great sense of responsibility. Since 1951, Genikes Insurance has been a leader in the insurance sector overcoming challenges by safeguarding our values and remaining true to our mission: honouring our clients trust. Genikes Insurance have been at the forefront of our society for seven decades and we owe it to ourselves to keep supporting individuals and businesses. My goal is to contribute towards the company’s further growth, modernize the company while adhering to its tradition and mission.

What does history contribute to the present as well as future prospects?

Genikes insurance remains true to its values. The company distinguishes itself for its’ reliability and responsibility and the professionalism of an experienced, knowledgeable and well-trained staff. These values have always been part of the company’s philosophy and operating model. Paving the way to the future, we are investing in technology and enhancing the network of our insurance agents. In the framework of this evolution, we have adopted a new corporate identity – one that highlights the company’s unique profile more than ever without relinquishing its historic name.

What is your company’s DNA and what defined it?

Our DNA has been defined by the very people who signed our establishment documents in November 1951 in London. It is no other than the development of insurance conscience and the local insurance industry with a true sense of responsibility toward individuals and businesses. We understand our role in our society and therefore it is in our DNA to forge trustworthy, life-long relationships with our clients, supporting them in a changing world. Integrity, reliability and professionalism will remain an integral part of our daily operational model, while fostering a culture of innovation and progress.

Landmarks

What has been the most important moment for you?

Genikes Insurance has a rich history and achieved many accomplishments along the way. 1951 has been a significant landmark as it marks the year of our establishment. It marked the starting point of a long, highly successful road that has distinguished Genikes Insurance as one of the most reliable insurers in Cyprus. A significant moment was also our transition to digital. In 1997, the archiving and management records and data electronic system was made operational, while that same year, Bancassurance was established. The year 2000 was equally brilliant, when the company’s financial results recorded a meteoric rise. In addition, significant progress was made in implementing the strategic direction of the Company.

What was the most important decision?

Every decision had its own significance, as it brought us to the position we enjoy today, a 70-year story of growth and success. Undoubtedly, one of the most important developments was our webpage, that counts thousands of clients’ visits. Today internet insurance is an established reality. But it wasn’t always possible. Genikes Insurance was always a step ahead and in 2017 became the only company in the sector to achieve such a feature.

Post pandemic

We’re facing a tough situation. Before even recovering from the financial crisis, covid came around.

The health crisis put the brakes on the growth that Cyprus had achieved after facing the difficult circumstances of the financial crisis. But I do remain optimistic. I believe that the country will once again find the strength and courage on the road to normality, with those crucial indicators rising again. No one really ones how the global market will turn out a few years from now, but what does make us optimistic is the dynamic rebound of industries and the country’s GDP. A massive effort is under way to gain lost ground and I think we’re moving in the right direction.

How do you see things post pandemic?

The pandemic forced business to reconsider everything. The pause in financial activity sent shockwaves internationally. It did however also bring about drastic changes. What’s certain is the speeding up of the digitalisation processes and the evolvement of companies’ operational models. At Genikes Insurance we had long decided to invest further in technology and human capital, developing digital service channels. Therefore, I do look forward to an even greater use of digital by the general public. Work will take place online, including activities that we considered impossible without physical presence. Trends refer to a combination of technology and personal contact. Phygital for example is constantly gaining ground. It was once rare working from home, with videoconferences few and far between. Today however it is the order of the day. And we’ve gained quite a bit of experience on that, we’ve adapted to different human interaction. What’s important is for every company to maintain its anthropocentric character, in co-existence with technological advances.

Major challenges

Do you consider your company’s technological upgrade as adequate on its own?

No, we won’t be falling into the trap of focusing our attention exclusively on technological parameters. It is, granted, a fundamental vehicle that will lead every company on the way to tomorrow, increasing client satisfaction. But the insurance sector is also dealing with other major challenges and we need to face them head on. Amongst them is the added challenge of insurance in the midst of climate change. The cost of reimbursing damages caused by extreme weather phenomena like floods, destructive storms and fires is absolutely massive. According to estimates, things are progressively getting worse and environmental repercussions growing. Such phenomena are translated into hundreds of billions of euro in damages internationally, with insurance companies paying most compensations.

On the other hand, we are also witnessing major legislative amendments that pave the way to new developments. The European directives harmonize and homogenize our market. Τhe regulatory framework is a challenge throughout Europe, particularly for small size insurance companies. But this framework is also an opportunity and it must be utilised on our way towards a new much more personalised and flexible organisation. In heading to that direction, training our staff in this new environment is a priority for Genikes Insurance and we will continue to invest in that in the years to come.

A pillar of stability and security, supporting people

Do you think that insurance in Cyprus is profitable?

Our sector is recording positive results and in spite pandemic effects, it continues a rising trend. However, overall, the insurance conscience in Cyprus, compared with other countries, is one of the lowest both among businesses and individuals.

At Genikes Insurance we take fostering insurance conscience very seriously. We often get involved in synergies with relevant bodies, aiming at making people more aware of the merits of insurance culture. We have a lot to offer and supporting people is a given. We provide a great range of insurance schemes at competitive prices, with excellent service. We do know that new needs arise constantly and that’s why we are implementing a comprehensive digital experience.

I am happy because our clients are trusting and are always seeking more insurance options from us. This is no accident. Our strategy, based on the three pronged approach of self-sufficiency, transparency and personalisation, make it easier for the client to build the insurance solutions best suited to them, communicate and remain informed, request changes and file claims, execute amendments and payments, seek and find information and data and monitor the development of their claims.

Where did the company focus during the pandemic?

None other than our human capital: our staff and our clients. We remain supportive of the individual in their insurance needs, but also remain a social pillar of stability and security. A dynamic, progressive company such as Genikes Insurance is simply obliged to contribute and support while offering the best possible service for its clients.

Address.

2-4 Themistokli Dervi, Nicosia

1066

Telephone.

8000.87.87